“If I asked you, would you buy a farm in New York City or Miami today? The answer is, of course you would, because the cost of a farm is generally valued at much less than equal acreage in a large city,” says Derek Distenfield, Managing Partner of DDB Capital Fund. This simple insight forms the foundation of his firm’s contrarian approach to America’s housing crisis.

In just six months since launching in January 2025, DDB Capital has secured 12 properties with over $140 million in development value, with plans to expand to 40 developments. Their strategy? Buying farmland in what Distenfield calls “exurbs,” suburbs of suburbs and developing them into master-planned communities with metropolitan-quality amenities.

The Housing Crisis Opportunity

America faces a housing shortage estimated between 2.5 and 5 million homes nationwide. This fundamental supply-demand imbalance creates opportunities regardless of interest rate fluctuations.

“Anyone who bought a home before COVID isn’t selling because they like their three-and-a-half percent interest rate,” Distenfield explains. “But these folks still have kids, and these kids grow up and want to move out. They need a place to live, that’s one of the most basic human needs.”

While many developers focus on trendy coastal markets or established tech hubs like Austin, DDB Capital sees opportunity in overlooked secondary and tertiary markets, particularly in the Southeast.

“I truly believe there’s nothing magic that makes people smarter in Austin,” Distenfield states. “People in Alabama, Tennessee, Mississippi, all over the country, have this shortfall of housing and would like the opportunities that trendier markets take for granted.”

From Tech to Dirt: A Data-Driven Approach

Distenfield’s journey to real estate wasn’t traditional. He started as a tech entrepreneur and investor, experiencing everything from “$0 flops to $2 billion exits” before moving into private equity. This background informs DDB Capital’s approach; the “DDB” stands for “data-driven builders.”

While they analyze quantitative market data, Distenfield emphasizes the importance of qualitative insights from builders on the ground. “Our business model is really simple. Our customer is builders,” he explains. “If a builder says, ‘I’m build-baby-build in this area,’ we’re interested because that’s our customer.”

This builder-centric approach helps identify markets that might not be getting national attention but have strong fundamentals. The firm targets areas like North Alabama, where expansions by the FBI and the relocation of Space Command are driving growth, or parts of Tennessee and North Georgia that haven’t yet seen development proportionate to their population growth.

“A lot of real estate data gets skewed with California and Florida and the coastal markets,” Distenfield notes. “If Florida is suffering, that’s obviously a decent portion of the real estate market as a whole, but the geographical implications could be much different outside of Florida.”

The Post-COVID Suburban Expansion

Post-pandemic trends are fueling DDB Capital’s strategy. “In a post-COVID world, people have identified that you don’t necessarily have to live in a downtown city,” Distenfield observes. “The joke in Atlanta is, if you live in Atlanta, it takes an hour to get to Atlanta because the market is expanding further and further away from downtown.”

This expansion into “exurbs,” suburbs of suburbs, is central to DDB Capital’s thesis. “I believe suburbs of suburbs is where growth will happen versus moving back towards the city,” Distenfield states. “Do you want to live in a forest of tall buildings, or do you want to live where you have more land and still have access to a major city?”

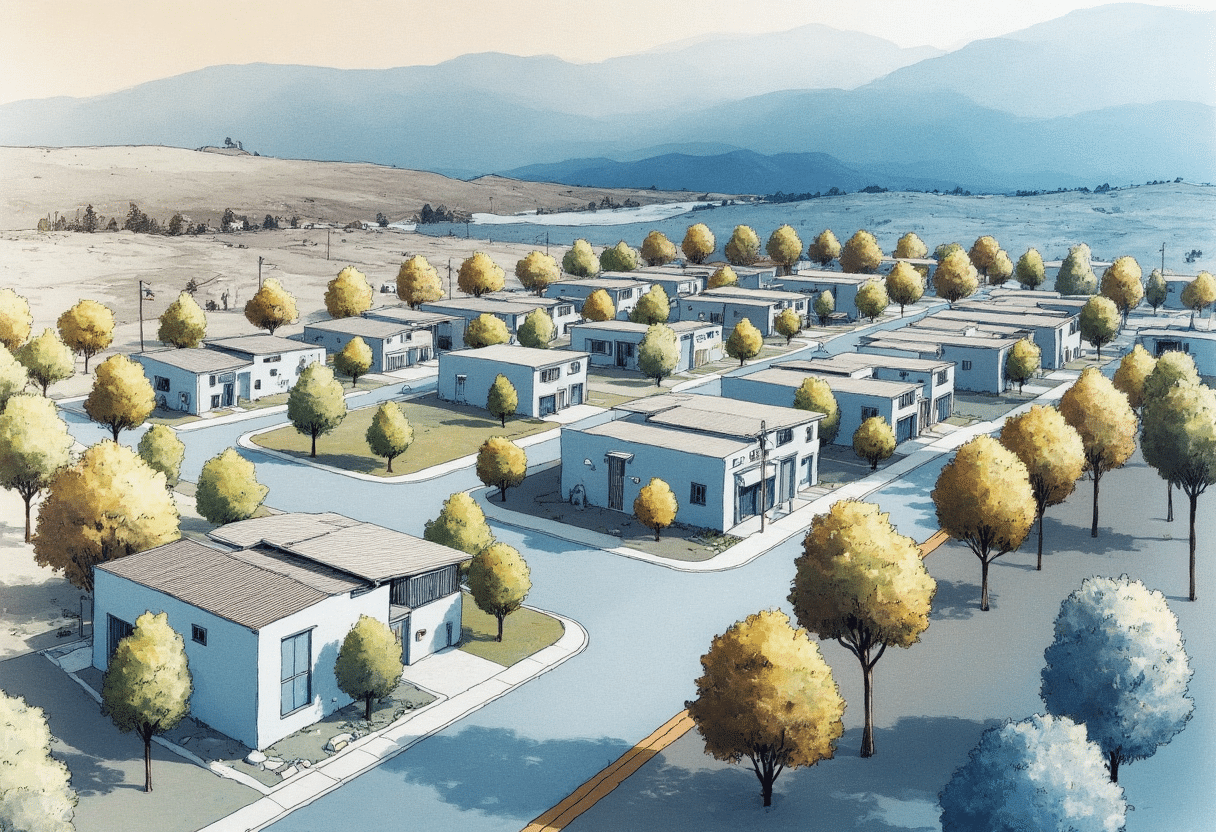

Building Complete Communities, Not Just Houses

DDB Capital isn’t just developing housing; they’re creating comprehensive communities. Their developments typically include 200-300 homes, often with retail integration and amenities like swimming pools, pickleball courts, and gyms.

“We really try to master-plan communities, and when it makes sense, we’ll add retail and create a mixed-use community,” Derek explains. “Whether it’s remote work or not, people want to live, work, and play all in one spot.”

This approach addresses a fundamental quality-of-life issue. “I once read a study that a psychologist said sitting in traffic is one psychological dilemma that you just can’t get over because it happens every single day,” he notes. “If you create that triangle where your house is here, you eat and play here, and you work close by, that’s what we’re really trying to build.”

Collaborative Development

Unlike some developers who might force their vision onto communities, DDB Capital prioritizes collaboration with local governments.

“We don’t move forward on any transactions without speaking with the city. We only build in cities that want to be built in,” Distenfield emphasizes. “We don’t behave the way Donald Trump did when he was a developer in New York, where we muscle into a city.”

Instead, the firm invests time building relationships with mayors and city planners. “A lot of what we spend our time on is getting to know mayors and city planners, understanding their plans, and figuring out how we can supplement and fit in, because they know better than us,” Derek says.

The Value Creation Model

The firm’s investment thesis is straightforward: identify farmland in growing markets, work with pro-growth municipalities to rezone it, and partner with builders to develop communities with high-quality amenities.

“There are growing communities in the Southeast where farmland is still available at a good price,”Distenfield explains. “You can work with pro-growth municipalities, rezone that farmland, and partner with reputable builders to build high-quality homes with amenities… there’s a huge opportunity where you could three to 5x the value of that land.”

With 14 properties already secured and plans to expand to 40 developments, DDB Capital is moving quickly to capitalize on their thesis while continuing to raise capital from investors in their network.

As real estate investors reassess overvalued coastal markets, DDB Capital’s strategy points to a compelling direction, tackling the housing shortage through scalable, community-driven development in high-growth suburban corridors.

Originally posted by Keycrew Journal

Credit: Steve Marcinuk

Disclaimer

This communication is intended for informational purposes only and should not be construed as an offer to sell or a solicitation to buy any securities, investment products, or services. Any offering will be made only through official offering documents to qualified investors. Past performance is not indicative of future results. Investing involves risk, including possible loss of principal. Please consult your legal, tax, or financial advisor before making any investment decision.