Breaking Down the Data: Validating Market Trends

Everyone talks about supply and demand like it’s some magic formula. More houses on the market? Prices drop. Fewer houses? Prices rise. Simple, right? Not quite. At DDB Capital, we don’t just accept market narratives at face value—we stress test them against real data.

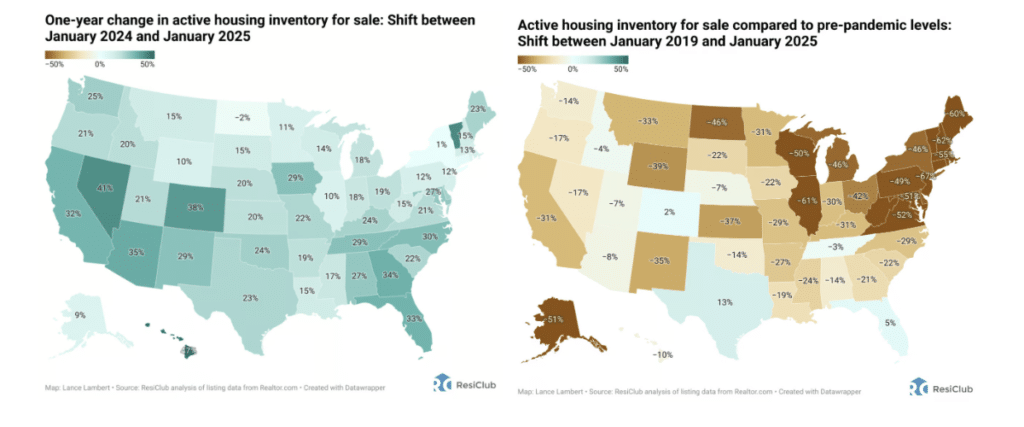

A recent article from ResiClub Analytics suggests that rising active listings and longer days on market are leading indicators of price weakness. Nationally, active listings are up 24.6% year-over-year, but still 25.3% below pre-pandemic levels. While some markets in the Sun Belt and Mountain West are already seeing shifts, the question is: does this apply to our target markets? More importantly, does it mean anything for our investors?

What Does the Data Say?

We analyzed six counties where DDB Capital operates, looking for correlations between key metrics and median home prices. The takeaway? Not all markets respond the same way and the devil is in the details. Our deep dive flagged certain counties sitting in “vulnerability ranges” based on real-time market data. This indicator signals where risk and opportunity may be shifting.

- Vulnerability Ranges define a county whose historical data suggests that based on current metrics, declines in key indicators (such as active listings, new listings, and days on market) may trigger above-average drops in median home prices

Measuring Market Sensitivity: Correlation Coefficients

In finance and science, correlation coefficients measure how closely two variables move together. A coefficient of 1 means a perfect positive correlation (they move together), while -1 means a perfect negative correlation (one rises as the other falls). Anything close to 0 means no meaningful relationship. While scientific studies use ±0.9 as the threshold for strong correlation, we set ours at 0.7 to ensure we’re testing the argument rigorously.

|

Baldwin |

Cullman |

Limestone |

Madison |

Montgomery |

Morgan |

|

|

Active Listings |

-0.73 |

0.15 |

0.12 |

-0.55 |

-0.63 |

-0.57 |

|

New Listings |

0.26 |

0.52 |

0.72 |

0.20 |

0.17 |

0.19 |

|

Days on Market |

-0.90 |

-0.76 |

-0.62 |

-0.69 |

-0.82 |

-0.70 |

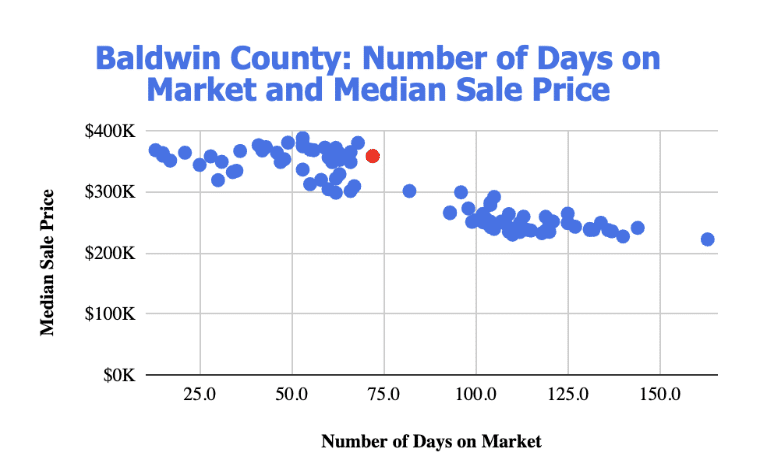

- Baldwin County: High correlation between days on market and median home price (-0.90). When homes sit longer, prices fall fast. Historically, when days on market increased by 48 days in 2014, prices followed with a steep drop. Based on current statistics, Baldwin County is also in a “vulnerability range” where shifts in key indicators could lead to above-average price declines (red dot indicates current market).

- Montgomery County: Also shows a strong negative correlation (-0.82), suggesting sensitivity to market slowdowns.

- Madison & Limestone Counties: Low correlation between active listings and price movements. These markets demonstrate stronger fundamentals with growing demand and rising incomes.

The Baldwin County Problem

Baldwin County’s data isn’t necessarily a red flag, but a flashing warning sign. When a market is this sensitive to longer listing times, any slowdown can quickly turn into price drops. Right now, median home prices sit at $359K, with an average of 72 days on market. If days on market creep higher, history suggests that prices will follow suit. And given historical price movements around the current range, this could be a greater than average price drop.

Bottom Line

DDB Capital bases decisions on market data. Current statistics indicate higher risk in Baldwin County, leading us to adjust our focus. In contrast, Madison and Limestone Counties demonstrate stability, with low sensitivity to fluctuations in active listings. Strong fundamentals — population growth, rising wages, and limited inventory — support resilience in these markets. We prioritize sound investments backed by data, avoiding unnecessary speculation.

Signal & Noise is a blog series created by DDB Capital Senior Analyst Johnathan Chavez. It critically examines articles from major real estate publications, using statistical analysis to verify or challenge their claims and assess their alignment with market realities

Disclaimer

This communication is intended for informational purposes only and should not be construed as an offer to sell or a solicitation to buy any securities, investment products, or services. Any offering will be made only through official offering documents to qualified investors. Past performance is not indicative of future results. Investing involves risk, including possible loss of principal. Please consult your legal, tax, or financial advisor before making any investment decision.