ALPHARETTA, GA, June 18, 2025 (PRNewswire) — The days of rigid fund structures, opaque strategies, and decade-long lockups may be numbered. In its latest thought leadership post, DDB Capital makes the case that a quiet revolution is reshaping alternative investing, driven by investor demand for liquidity, transparency, and consistent cash flow.

Titled “Rethinking Investment Models: The Quiet Revolution in Alternative Investing”, the firm’s newest blog outlines why outdated paradigms like the 60/40 portfolio and traditional venture capital are struggling to meet today’s expectations — and why hybrid, flexible structures are the future.

“Markets have changed. Investor expectations have changed. But too many fund structures haven’t,” said a spokesperson for DDB Capital. “Our model is built around the idea that capital should work harder — and return sooner — for investors.”

Key Insights from the Blog:

- 📉 The 60/40 Portfolio Is Obsolete: Low bond yields, volatile equities, and a broader embrace of alternative assets have rendered the classic allocation outdated.

- 🚨 Venture Capital’s Liquidity Crunch: With frozen IPO markets, overvalued unicorns, and massive unfunded commitments, the traditional VC model is under pressure.

- 💡 New Investor Priorities: Investors increasingly demand transparency, cash distributions, and capital flexibility — attributes that are rare in legacy PE/VC structures.

- 🔁 The DDB Difference: Early and consistent cash flows, reduced capital risk, and shorter commitment cycles allow investors to compound returns and retain control.

DDB Capital’s investment approach emphasizes asymmetric risk, annual payouts, and fund structures built for today’s environment — not for the last cycle.

“We’re not chasing unicorns or locking up investor money for 10 years. We’re building real assets, delivering real returns, and giving investors the liquidity they deserve,” explained DDB Capital Managing Director Derek Distenfield.

Read the Full Insight

Explore DDB Capital’s full perspective on why the investment industry is overdue for structural change:

👉 Rethinking Investment Models: The Quiet Revolution in Alternative Investing

About DDB Capital:

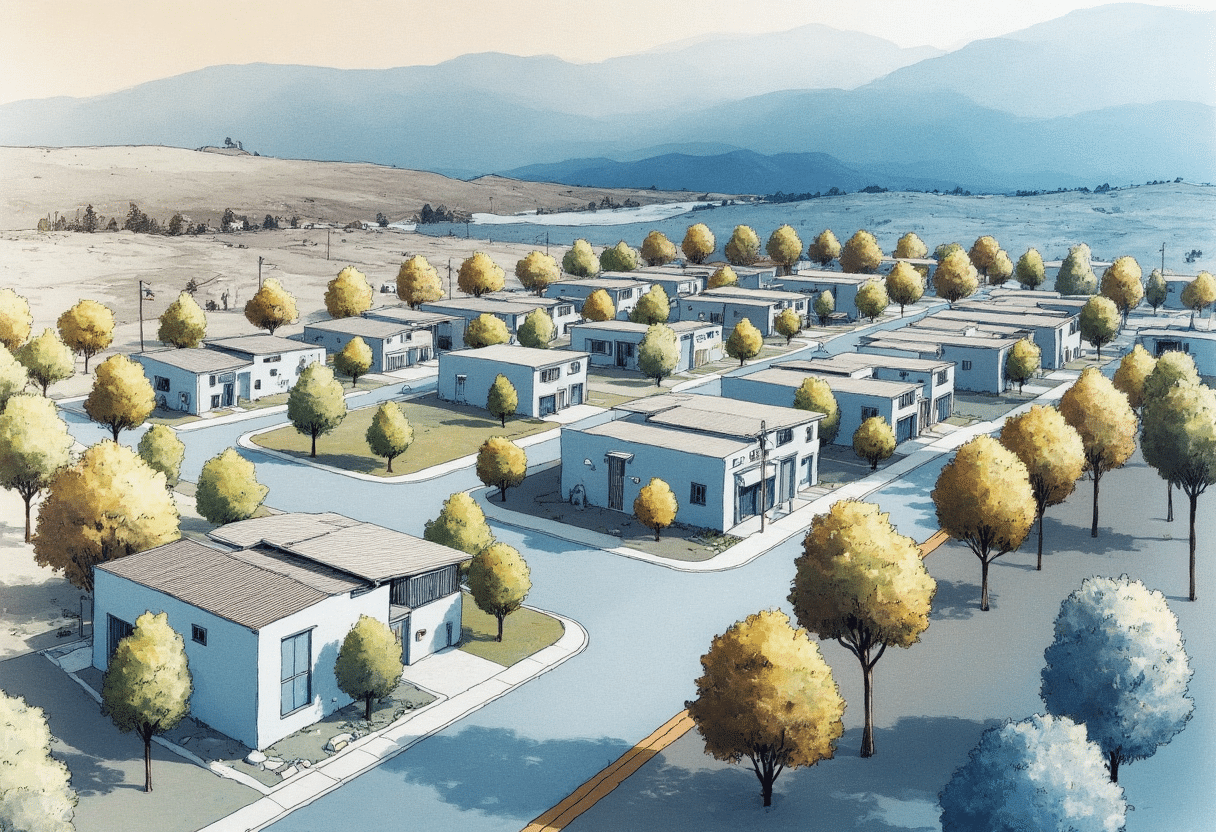

Our mission is to drive innovation in real estate development while fostering thriving communities and sustainable growth. We are committed to delivering transformative developments that create lasting value for both investors and residents across the Southeast. For more information, visit www.ddbcapital.com.

Disclaimer

This communication is intended for informational purposes only and should not be construed as an offer to sell or a solicitation to buy any securities, investment products, or services. Any offering will be made only through official offering documents to qualified investors. Past performance is not indicative of future results. Investing involves risk, including possible loss of principal. Please consult your legal, tax, or financial advisor before making any investment decision.