As market analysts increasingly forecast a U.S. recession, sophisticated investors are scrutinizing the resilience of their portfolios. At DDB Capital, our strategy stands apart from traditional real estate funds, particularly in how we manage liquidity and price risk.

Our model avoids the traditional buy-and-hold model. Instead, we secure land through options contingent on successful rezoning to residential use, allowing for same-day closings once approvals are in place. This structure gives us flexibility — if a local market sees sharp price drops or reduced liquidity, DDB can walk away from individual deals or pause activity in entire regions, significantly limiting downside risk.

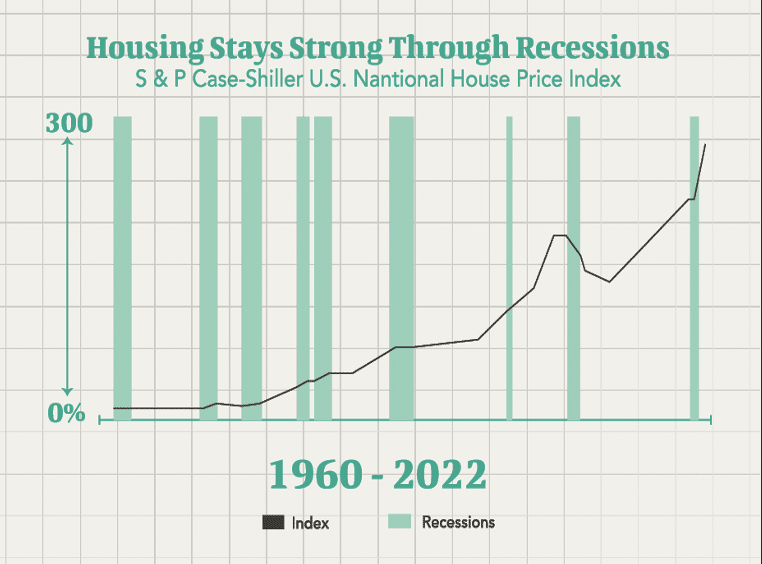

Our investment thesis targets properties with the potential to at least double in value post-rezoning. Given this level of value creation, mild recessions, which historically result in housing price declines of 5% to 10%, according to the S&P/Case-Shiller Home Price Index, pose minimal risk to overall performance. Even in more severe recessions, where residential prices may fall 15% to 30%, the margin created through rezoning continues to protect our return profile.

The historical context supports this assessment. During the 2001 recession, national home prices remained relatively stable, with only negligible average declines, according to the S&P/Case-Shiller Home Price Index. In contrast, the 2008 recession triggered sharp corrections—markets like Phoenix, Las Vegas, Miami, Los Angeles, and Detroit saw residential prices fall by 40% to 60%. However, these extreme cases were outliers, driven by systemic issues unlikely to repeat in today’s environment.

Geographic diversification significantly reduces concentration risk and strengthens portfolio resilience. At DDB Capital, we focus on high-growth regions in Georgia and Alabama, with plans to strategically expand into additional states in the near future. Recently we discussed how we identify which regions to focus on.

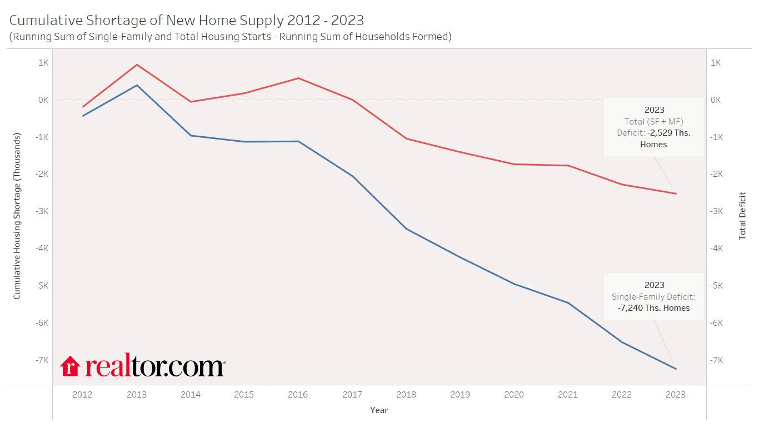

At its core, the U.S. housing market remains structurally undersupplied. Even in downturns, underlying demand persists and inventory is quickly absorbed once conditions improve. This ongoing shortage acts as a natural buffer against prolonged declines, reinforcing DDB’s optimistic outlook despite recessionary pressures.

In short, despite recession risks, DDB Capital’s flexible model, disciplined valuations, targeted market focus, and persistent housing shortage position the fund to perform well even in challenging economic conditions.

Sources:

Disclaimer

This communication is intended for informational purposes only and should not be construed as an offer to sell or a solicitation to buy any securities, investment products, or services. Any offering will be made only through official offering documents to qualified investors. Past performance is not indicative of future results. Investing involves risk, including possible loss of principal. Please consult your legal, tax, or financial advisor before making any investment decision.